lake county sales tax ohio

Click here for a larger sales tax map or here for a sales tax table. Map of current sales tax rates.

Ohio Sales Tax Guide For Businesses

105 Main Street Painesville OH 44077 1-800-899-5253.

. To review the rules in Ohio visit our state-by-state guide. If you need access to a database of all Ohio local sales tax rates visit the sales tax data page. 105 Main Street Painesville OH 44077 1-800-899-5253.

Choose this option for a complete list of county auditors as compiled by the County Auditors Association of Ohio Out-of-State Seller - Ohio law requires any out-of-state person or business making retail sales of tangible personal property or taxable services into Ohio to register for a sellers use tax account once substantial nexus is met. The Toledo Area Regional Transit Authority TARTA enacted a 50 sales and use tax effective April 1 2022. Average Sales Tax With Local.

The current total local sales tax rate in Lake County OH is 7250. Lake county ohio sales tax on cars. Ohio has 1424 cities counties and special districts that collect a local sales tax in addition to the Ohio state sales taxClick any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code.

105 Main Street Painesville OH 44077 1-800-899-5253. The states sales and use tax rate is currently 575. 105 Main Street Painesville OH 44077 1-800-899-5253.

The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Lake County local sales taxesThe local sales tax consists of a 125 county sales tax. Lake 100 050 725 Wood 100 675 Lawrence 150 725 Wyandot 150 725 Note. The Lake County Sales Tax is 15.

The December 2020 total local sales tax rate was also 7250. The Lake County sales tax rate is. Lake County in Ohio has a tax rate of 7 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Lake County totaling 125.

The Ohio state sales tax rate is currently. If this rate has been updated locally please contact us and we will update the sales tax rate for Lake County Ohio. The TARTA makes up the entirety of Lucas County and the City of Rossford in Wood County.

The 2018 united states supreme court decision in south dakota v. There are a total of 583 local tax jurisdictions across the state collecting an average local tax of 1473. Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225.

105 Main Street Painesville OH 44077 1-800-899-5253. Type the parcel ID into the search box above. Automating sales tax compliance can help your business keep compliant with changing.

Search by parcel number. Lake county collects a 1 25 local sales. These buyers bid for an interest rate on the taxes owed and the right to collect back.

The 2018 United States Supreme Court decision in South Dakota v. Lake county tax rate 7 25 previously 7 00 note. The sales and use tax rate for Paulding County 63 will increase from 675 to 725 effective January 1 2022.

Ohio collects a 5 75 state sales tax rate on the purchase of all vehicles. Use the to find a group of parcels. Has impacted many state nexus laws and sales tax collection requirements.

Sales tax in Lake County Ohio is currently 7. All parcels that begin with 16A. Lake County Ohio.

The sales tax rate for Lake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Lake County Ohio Sales Tax Comparison Calculator for 202223. Lake County Ohio. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 075.

Lake County OH currently has 507 tax liens available as of March 25. - The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County.

A county-wide sales tax rate of 15 is applicable to localities in Lake County in addition to the 575 Ohio sales tax. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Lake County OH at tax lien auctions or online distressed asset sales. The sales and use tax rate for Mahoning County 50 will increase from 725 to 750 effective April 1 2022.

Encyclopedia Of Cleveland History Haymarket London England Downtown Cleveland Urban Landscape

Ohio Sales Tax Rates By City County 2022

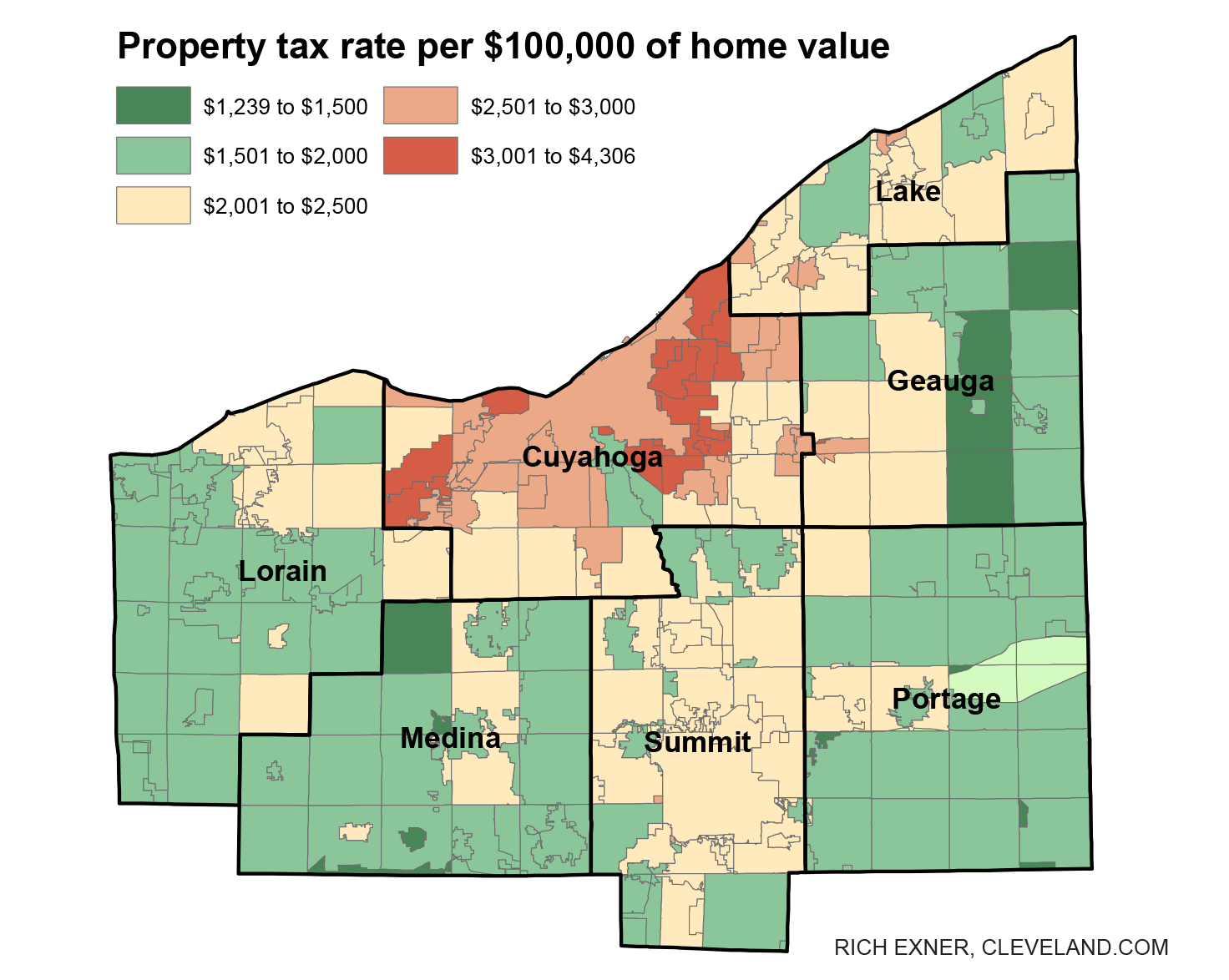

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Which State Has The Highest Percentage Of Forest Cover United States Map United States History Map

Visit Http Www Mayspix Com For Even More Pix Ohio Akron Ohio Akron

A Fall Sunset On The City Of Cleveland By Max Huber Cleveland Museum Of Art Forest City Cleveland Metroparks

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Vintage Ohio License Plate Green White 1974 Free Shipping Etsy License Plate Garage Decor Ohio

Bandstand In The Gallipolis City Park Remembering My Nephew S Wedding In Gallipolis Whole Family Was There House Styles This Is Us Concrete Wall

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Pioneers Of Westlake Ohio Book Now Available Westlake Bay Village Observer West Lake Ohio Books

Pin By Stacey Malone On Why I Love Berea Oh Cleveland Cleveland Browns Cleveland Ohio

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

If You Have Ever Bought Or Sold A Home You Will Understand This Real Estate Meme The Actual Home Value As Ohio Real Estate Real Estate Fun Real Estate Memes

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com