loveland co sales tax online

Effective January 1 2019 Larimer County sales and use tax has increased to 8. Noncompliance results in a penalty equal to 10 of the tax remaining due over 10000 after the estimated payment deadline of January 31.

An alternative sales tax rate of 765 applies in the tax region Windsor which appertains to zip code 80538.

. Loveland in colorado has a tax rate of 655 for 2022 this includes the colorado sales tax rate of 29 and. The Loveland Colorado sales tax rate of 67 applies to the following three zip codes. Loveland is located within Larimer County Colorado.

The Loveland sales tax rate is. Residents can also pay City sales tax online at. Within Loveland there are around 3 zip codes with the most populous zip code being 80538.

Welcome to Sales Tax. Reserve a Meeting Room at the Chilson Center. The City of Loveland Loveland uses ACH debit for all online payments.

An alternative sales tax rate of 77 applies in the tax region Berthoud which appertains to zip code 80537. The Colorado Department of Revenues Sales and Use Tax Simplification SUTS Lookup Tool is available to lookup municipality and delivery address sale tax rates. This includes the rates on the state county city and special levels.

The average cumulative sales tax rate in Loveland Colorado is 67. Sales Tax License Renewal Form. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

The minimum combined 2022 sales tax rate for Loveland Colorado is. The December 2020 total local sales tax rate was 6700. To view Building Permits click Public Access from the choices on the left no login credentials needed For Sales Tax please provide email login and password.

The average sales tax rate in Colorado is 6078. Welcome To Citizen Access our Online Sales Tax Portal. Sales tax return forms are available at.

Sales Tax Rate The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. The exemption for sales of machinery or machine tools pursuant to 39-26-11411 Colorado Revised Statutes shall not apply to the sales tax and the sale of such items is expressly made taxable under this chapter. 500 East Third Street Ste.

The sales tax rate does not vary based on zip code. 110 Loveland CO 80537 Phone. 2020 REPORTS January 2022.

The sales tax rate does not vary based on zip code. Third Street Loveland CO 80537 Phone. There are a few ways to e-file sales tax returns.

The Loveland Sales Tax is collected by the merchant on all qualifying sales made within Loveland. On Thursday June 2 2022. Complete Edit or Print Tax Forms Instantly.

Centerra Fee District Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees. Reserve a Meeting Room at the Public Library. First Time Users - Please Read.

Loveland co sales tax rate. The Colorado sales tax rate is currently. Loveland in colorado has a tax rate of 655 for 2022 this includes the colorado sales tax rate of 29 and.

Loveland in Colorado has a tax rate of 655 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Loveland totaling 365. For more information please visit the PIF RSF Fees page. Groceries are exempt from the Loveland and Colorado state sales taxes.

For additional e-file options for businesses with more than one location see Using an. For questions call 970 962-2708. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Loveland Colorado sales tax is 655 consisting of 290 Colorado state sales tax and 365 Loveland local sales taxesThe local sales tax consists of a 065 county sales tax and a 300 city sales tax. 80537 zip code sales tax and use tax rate loveland larimer county colorado sales tax and use tax rate of zip code 80537 is located in loveland city larimer county colorado state. In 2018 Larimer County voters approved a county-wide one-quarter of one percent 25 county-wide sales tax to.

101 rows the 80537 loveland colorado general sales tax rate is 67. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Theyre a capital anchor for public services in support of cities schools and special districts such as water treatment stations public safety services recreation and others.

The current total local sales tax rate in Loveland CO is 3700. Pay My City Sales Tax. Start Move or Expand Your Business.

This is the total of state county and city sales tax rates. 80537 80538 and 80539. They can be downloaded by clicking on the icons below.

The average sales tax rate in Colorado is 6078. Property taxes are a crucial source of income for Loveland and other local public units. Some financial institutions have a debit block that will not allow ACH debit payments to go through.

The imposition of the sales tax on individual sales shall be in accordance with schedules set forth in the. 670 Sales Tax Chart. Method to calculate Loveland sales tax in 2021.

We are pleased to offer our sales tax customers an online payment option through Citizen Access. Free viewers are required for some of the attached documents. If you have more than one business location you must file a separate return in Revenue Online for each location.

You can find more tax rates and allowances for Loveland and Colorado in the 2022 Colorado Tax Tables. For tax years 2015 and prior the Loveland Income Tax Code Chapter 183 Section 07 requires individual taxpayers having estimated taxes due in excess of 10000 to pay on a quarterly billing schedule. The County sales tax rate is.

Download our Colorado sales tax database. Loveland Sales Tax Rates for 2022. Standard Municipal Home Rule Affidavit of Exempt Sale.

Loveland CO Sales Tax Rate. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. Ad Access Tax Forms.

For additional e-file options for businesses with more than one location see Using an.

What Is Happening With The Outlets At Loveland A Sale Could Be Next

Jax May Move Into Former Kmart Location In Loveland Greeley Tribune

Loveland Council Group Used Private Text Messages To Discuss Ban On Flavored Vaping Tobacco Product Sales Loveland Reporter Herald

Development Center City Of Loveland

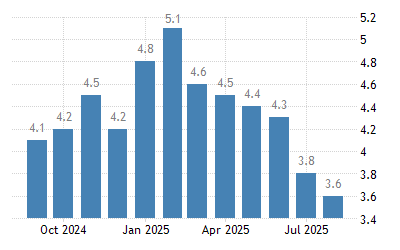

Fort Collins Loveland Co Unemployment Rate In Fort Collins Co Msa 2022 Data 2023 Forecast 1990 Historical

9001 Four Wheel Dr Loveland Co 80537 Realtor Com

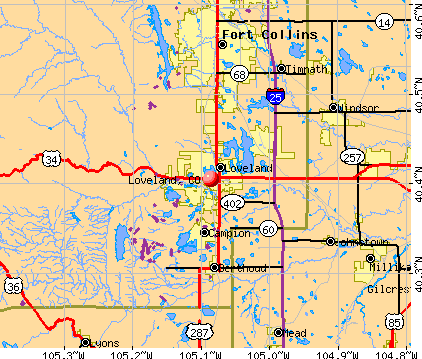

Loveland Colorado Co 80538 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Loveland Jax Store Could Move Into Former Kmart Location Loveland Reporter Herald

Loveland Colorado Co 80538 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Metropolitan Districts Return To Loveland City Council Agenda Loveland Reporter Herald

Lawn Care Contract Template Inspirational Lawn Care Proposal Template Lawn Care Proposal T Employee Handbook Template Business Proposal Template Quote Template

/https://s3.amazonaws.com/lmbucket0/media/business_map/boost-mobile-co-loveland-252-e-29th-st-80538.89814675b9a4.png)

Boost Mobile 273d E 29th Loveland Co

Loveland Colorado Co 80538 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Loveland Wants Colorado To Settle Netflix Sales Tax Issue Loveland Reporter Herald

Faq Loveland Fire Rescue Authority Loveland Co

Loveland Waterpark Resort Resurfaces With Rocky Mountain Grand Resort

Loveland Looking For Suggestions To Name 3 Natural Areas Loveland Reporter Herald