tax forfeited land morrison county mn

Interested buyers may also contact Land Services staff at 218-824-1010 or email Land. Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes.

Property Tax Morrison County Mn

W Walker MN 56484.

. Tax-forfeited land managed and offered for sale by St. Jail Inmate List. 3 Assurance fee 25 State Deed fee 46 Recorder fee 033 Deed tax if over 500 or 165 if 500 and under.

Credit cards accepted include. General Information about Crow Wing County Tax Forfeited Land Sales. The sale will be governed by the provisions of Minn.

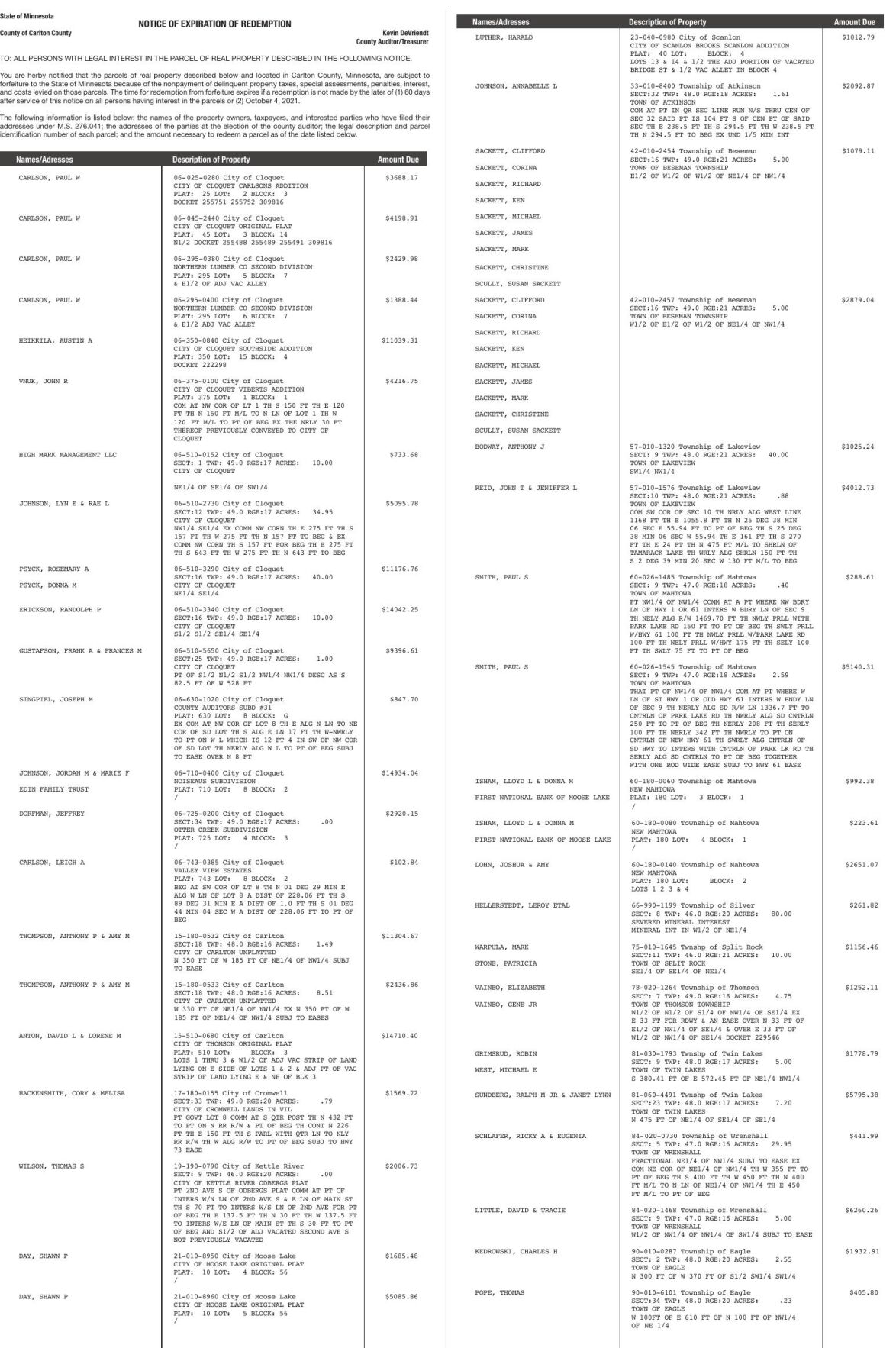

For over a century the citizens of Minnesota have authorized the government and the courts to confiscate a taxpayers real property as a last resort in order to compensate the taxing. The following parcels did not sell and are currently available for purchase over the counter at the. Lands that have forfeited for non-payment of general real.

What fees are involved with purchasing forfeited land. Download Entire Notice of Tax Forfeited Lands 10-6-2015 Revised 03-23-2022 NOTICE OF PUBLIC SALE OF TAX-FORFEITED LANDS. Beltrami County Reserves the right to withdraw any auction parcel at any time.

When a tax forfeited parcel is sold the AuditorTreasurers Department collects an amount equal to 3 of the total sale price of the land which is in addition to the price of the. Morrison County AuditorTreasurer 213 1st Avenue SE Little Falls MN 56345. View Cass County information about tax forfeited.

Tax forfeited parcels are properties on which delinquent property taxes were not paid title to the land and buildings was forfeited and title is now vested in the State of Minnesota. Morrison County Property Taxes. Credit Card or eCheck.

Property Tax Programs Applications. If a property does not sell at auction it may be available. Phone 218547-7247 Fax 218547-7278.

NOTICE IS HEREBY GIVEN that. Tax-forfeited properties are sold at public auction periodically as salable parcels become available. 28201 and by the resolution of the Todd County Board of Commissioners authorizing such sale.

The DNR is directed by state law to review authorize and approve the sale of certain tax-forfeited lands ie. A public auction of tax forfeited property was held on July 27 2022. Tax forfeited parcels are properties on which real estate taxes were not paid title to the land and buildings was forfeited and they are now vested in the State of Minnesota.

If you have any questions please feel free to contact our office at 218-333-4210. Based on recent LandWatch data Morrison County ranks ninth among the 87 counties in the state for its total acres of rural properties ranches and hunting land available for sale.

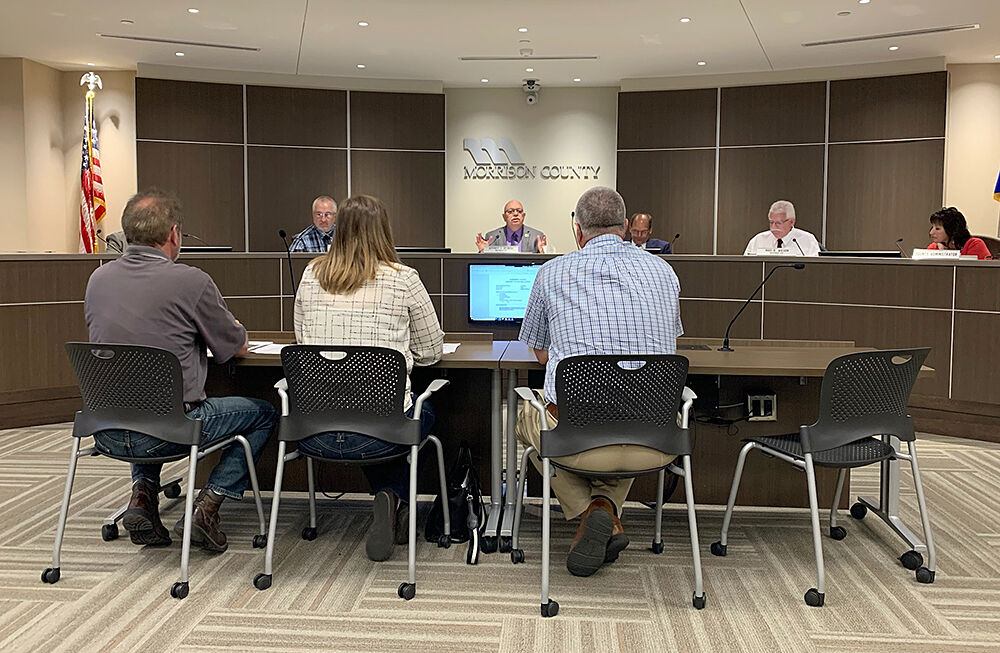

County Prepares To Sell Tax Forfeited Land Free Hometownsource Com

Morrison County Mn Official Website

Minnesota Tax Sales Tax Deeds Tax Sale Academy

06 06 06 Transcript And Report Cass County Minnesota

The Top How To Buy Tax Forfeited Land Mn

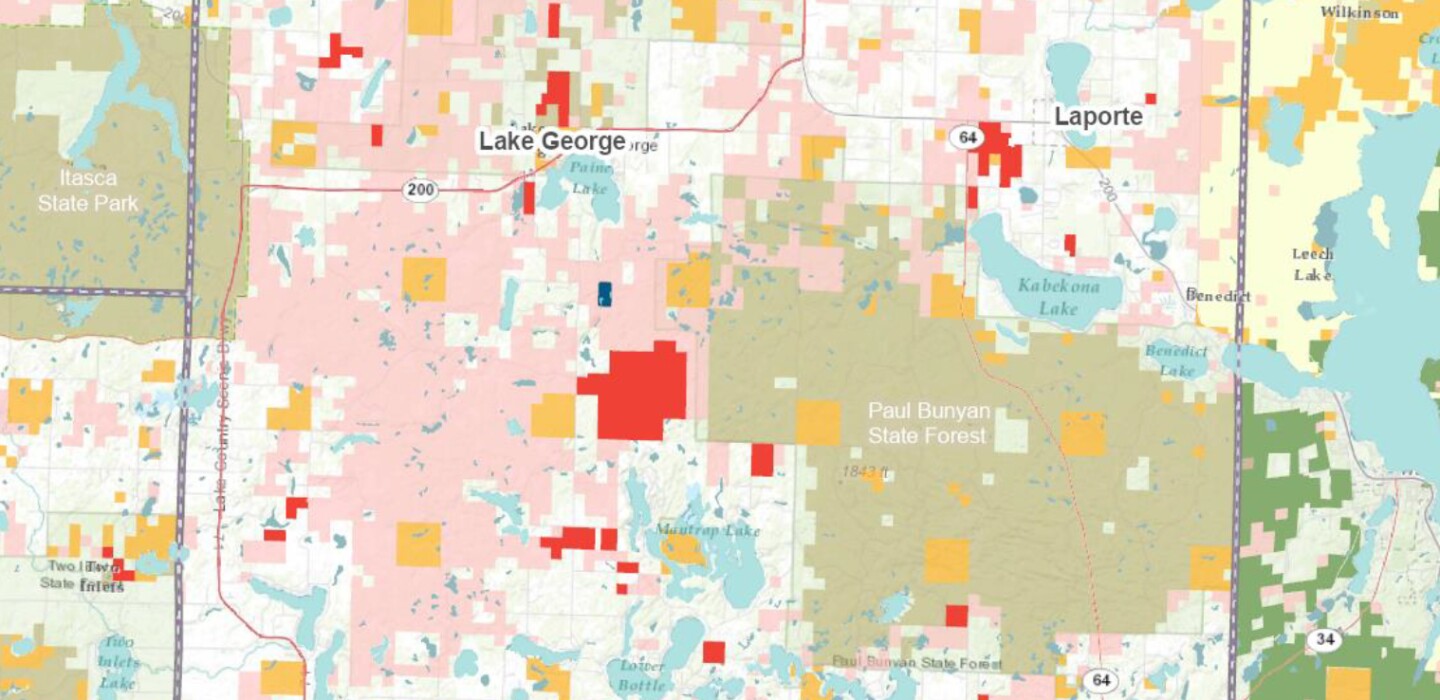

Potlatch Selling 10k Acres In Hubbard County Park Rapids Enterprise News Weather Sports From Park Rapids Minnesota

Minnesota Tax Sales Tax Deeds Tax Sale Academy

House Circa 1855 To Be Auctioned Oct 18 News Southernminn Com

Property Tax Morrison County Mn

5 7 Acres In Cass County Minnesota

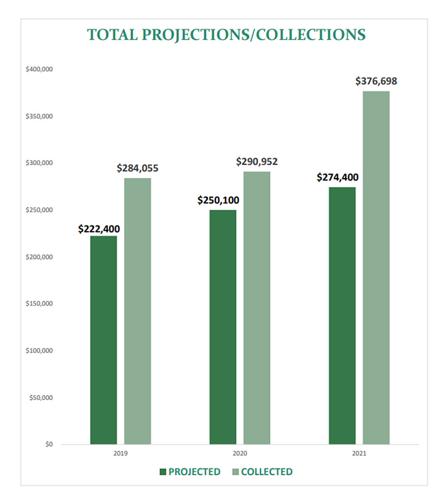

Morrison County Collections Up Nearly 86 000 From 2020 News Hometownsource Com

New Easement Program Available For Landowners In Eastern Morrison County Morrison County Record Hometownsource Com